Hayat Fund Statistics

Micro-Businesses

Beneficiaries

Millions of US Dollars Total Portfolio

The proportions of projects by sector

Vision

To be a seed of a microfinance development bank that following best practices in this field.

Mission

Elevate Syrians from the level of receiving assistance and relief to the level of production.

Goal

Providing the Syrian society with an easy and flexible Microfinance mechanism to reduce the burden and dependence on humanitarian relief organizations.

Portfolios

ER Portfolio Maysara

It is a portfolio designated to cover the urgent need for cash, and its amounts are much less than those in other portfolios,(up to a maximum of $ 400)

It’s your home (DARKUM) Portfolio

A portfolio for IDPs (internally Displaced People) who have settled in their new residence. We plan through this portfolio to re-engage them with public life and to enable them to resume their incomegenerating activities

Hope (AMAL) Portfolio

It’s for PwD (people with disabilities) since that securing incomegenerating activity for this group of people is the most successful treatment to re-engage them with life, and to get them out of their psychological situation, besides it can make him feel that he is still active in his society

HEP High Education Portfolio

This portfolio is designed to provide credits to the students in Syria who can’t afford the high education costs, and especially to those who had to leave their studies because of the current circumstances

WEP Women Empowerment Portfolio

This portfolio is designed for the women who headed their household (Widow, divorced, wives of detained or missing husbands) including an intensive training program before funding

Rizk Portfolio

It is a portfolio that operates with the Islamic Finance Mechanism (Murabaha contract) aiming to increase the sense of responsibility on the beneficiaries as studies have shown that the beneficiaries of the funds that contain a certain revenue (interest or Murabaha) have a higher sense of responsibility and thus their projects succeed better being more serious about managing it, and also this portfolio is a good financial resource for Hayat Fund, through which a portion of operating expenses are covered and thus maintaining the financing portfolio from erosion and melting in operational and financial expenses

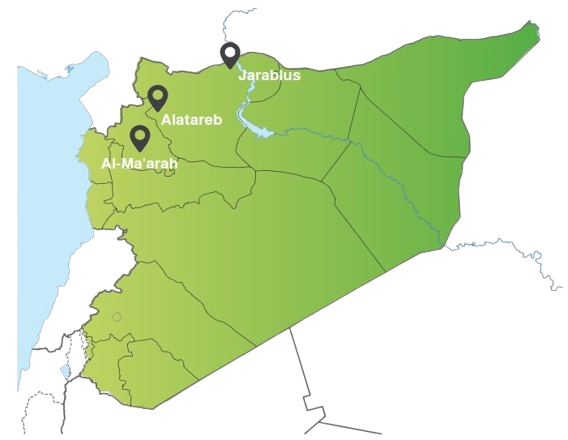

Hayat Fund was planned to be active in relatively safe areas, which are the core environment for microfinance, here are our three main branches:

1. Western Aleppo Countryside: through the branch of Hayat Fund in the city of Alatareb.

2. Northern Idlib countryside: Through our branch in the city of Maarrat.

3. North Eastern Region of Aleppo: which includes Jarablus and Albab.

Terms and conditions to obtain finance for Micro-Business

The applicant must be the owner and manager of the applied Micro-Business.

His age must be between 18 and 59 years old.

The applicant must have a good credit history.

The applicant must live in Hayat Fund’s core areas.

To own an existing income-generating Micro-Business.

That solidarity case in his group must be solid that they must pay when the rest of the group members default.

The group members must not be related to each other in the first or second level.

We Found a group of 3 to 5 members who know each other, Each applicant has an independent Micro-Business of the rest of the group members.

News

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.